Obligation of the self-employed to use a billing program

Patrick Gordinne Perez2025-04-18T11:02:51+00:00There is a lot of confusion among freelancers about whether a billing program should be used. Many customers ask us:

When will the electronic invoice be mandatory?

Whether you have to bill or not.

If you have to use an online billing program.

If you have to make an electronic invoice, or when the obligation to make an electronic invoice begins.

What is clear is that from 2026, all companies and freelancers who have a business will be obliged to issue their invoices from an approved billing program.

You just have to decide to use this billing program with Verifactur or without Verifactur.

In this article, we will try to clarify all these issues.

When is electronic invoicing mandatory?

The electronic invoice has been used in contracting with the public sector, but not in the private sector.

There has been a lot of news that electronic invoicing will be mandatory for freelancers and companies, but this is not the case.

For a law to be applied, not only must the law be published in the BOE, but it is necessary to publish the regulatory development of said law, the sanctioning regime of the law, etc. and in the case of electronic invoices it has not yet been done.

In fact, and according to the Treasury, the development of the regulations of the mandatory electronic invoice is on stand-by and they are more concentrated on what they have called Verifactur.

In fact, this is the easiest way to keep us under control. Let’S See

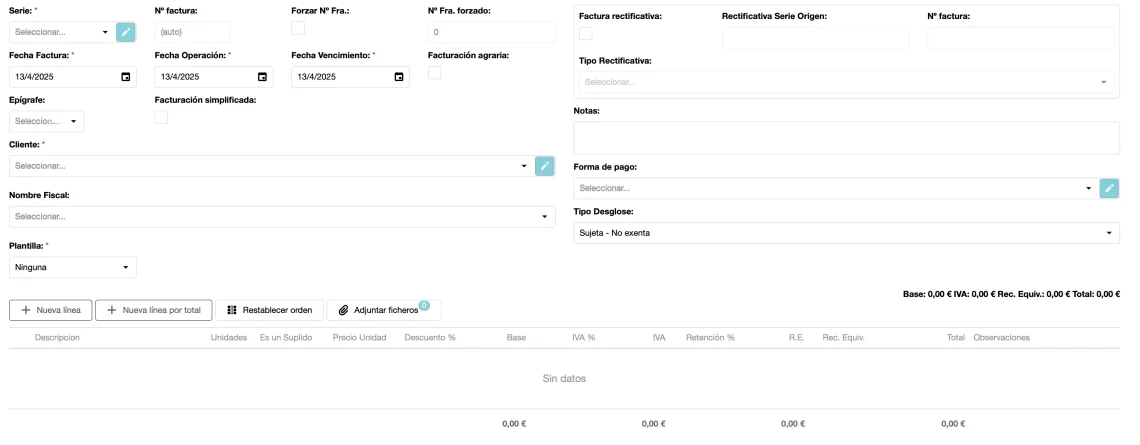

Approved billing program

What Hacienda Hacienda has done, is first, to control the companies that manufacture billing software.

Recently, the technical specifications have been approved that will mark a before and after in the so-called “invoicing computer systems” (SIF) that companies will have to implement from 2026 have been approved.

This change is an opportunity to evolve and adapt to the future, promoting innovation and efficiency in business processes. (This is said by the treasury because in reality what they want is to prevent companies and freelancers from modifying or eliminating invoices).

Discover how this advance can positively transform your business and open new doors to success.

In other words, the treasury has established technical and computer rules and requirements so that we cannot modify, alter or traffic the invoices we issue. And logically get that information as quickly as possible.

It is clear that self-employed companies with a certain volume already issue their invoices from a billing program.

But what about the small self-employed who barely issues invoices?

Will a freelancer be obliged to use a homologous billing program?

The answer is YES

New billing obligation

But before forcing us to use those billing programs, what Hacienda has done is to force manufacturers that software to meet certain requirements so that the records of the billing programs cannot be altered.

The regulations introduced in 2021, which oblige both manufacturers of billing software and users of such billing programs to ensure that computerised billing systems (IFS) guarantee the traceability and inalterability of records, is essential.

In other words, the Treasury has established computer requirements so that we cannot modify, change, alter or eliminate the invoices we issue.

Anything we do will be registered and the Treasury will know it.

According to them, this regulation not only protects the integrity of transactions, but also strengthens confidence in the financial system by ensuring that each record is accurate and reliable.

Implementing these measures is a crucial step towards a more transparent and secure management.

However, it was in October 2024 when its requirements and technical specifications were published.

The Spanish tax agency is going to force us to use billing programs and also that this software meets the requirements that it says to prevent us from modifying or deleting invoices.

Since when will it be mandatory to use a billing program?

Entry into force

Well, although it was expected that this new obligation would be applied from July 2025, the Treasury has made public an information note delaying the deadlines:

- For companies who pay the IS, the new rules on the SIFs will begin to apply from January 1, 2026.

- For the others, such as the self-employed who declare for personal income tax, they will come into force from July 1, 2026.

What if it is from July 2025 is the obligation of manufacturing companies to have the software approved.

It will be mandatory for . Use a billing program approved by the treasury

Am I required to use a billing program?

Forced to use billing programs

Most freelancers and companies will be obliged to use the new billing programs, which is a cause for concern for many freelancers.

In effect of the 3 million self-employed in Spain, many do not use a billing program either because it is very expensive, or because they do not need it, or because they invoice very little or because they do not know.

The fact of forcing freelancers to use a billing program can have a great impact on your business.

This obligation applies both to invoices issued to other companies and to those addressed to final consumers.

Which freelancers will be obliged to use a billing program?

Among those affected are, among others:

- Companies, except for fully exempt entities, must take immediate action.

- Also personal income tax payers such as the self-employed who develop economic activities.

- IRNR taxpayers with a permanent establishment in Spain.

- Entities under income attribution regime, such as communities of property or communities of owners with economic activity.

Not required to use billing programs

Some exceptions to the obligation to adapt to the new SIFs have been established.

For example, they are not required to use billing programs:

- Landlords of real estate who declare real estate capital income.

- Taxpayers who already manage their invoice registration books through the new Immediate Information Supply (SII) system.

- Those farmers, winners and fishmongers in the regimes of agriculture, livestock and fishing, equivalence surcharge and simplified VAT, when they do not have to issue an invoice.

VeriFactu or not Verifactu

This is the key word of all this mess

What does Verifactu mean?

Verifactu is a system that allows you to send all the records to the Treasury automatically and securely when entering the data.

You have two options to use the billing programs:

Non-verifiable billing programs

One option is the billing programs that do not send the billing records to the Treasury.

Such billing programs or computer systems – considered non-verifiable – must meet numerous technical requirements, and the information contained therein must be available to be sent to the Treasury as soon as it requests it.

Billing program, verifiable or Verifactu

The alternative is the Verifactu billing programs, with fewer technical requirements, but which send the records to the Treasury automatically when entering the data.

Tax Agency Free Billing Program

Free billing app

It is planned that the Treasury will enable a free application of this second modality (Verifactu systems), which can be an alternative for SMEs and self-employed who issue few invoices a year and do not want to spend money on acquiring a SIF.

Asesoria Orihuela Costa provides you with a billing program included in the monthly fees

In our desire to help you in your business, we have achieved this billing program and we include it in our accounting and tax fee.

Sanctioning regime for the use of billing programs that do not meet the requirements

Therefore, if your company is impacted by this change, it is important that you contact the supplier of your billing program to confirm that it complies with the new technical requirements established.

It is crucial to keep in mind that not complying with these regulations may result in a penalty of 50,000 euros for each year in which the provisions are not complied with.

As of January 1, 2026, companies that are taxed in the Corporate Tax must use the authorised billing programs.

The self-employed who pay personal income tax will be obliged to use the new billing programs from July 1, 2026.

In summary

- All companies and self-employed, who have an economic activity (with a few exceptions), must use an approved billing program from 2026.

- The taxpayer will be able to choose whether to use a billing program with or without Verifactu.

- The Verifactu system is the possibility of sending all the records of the billing program automatically to the hacienda.

In other words, all programs will have to have Verifactu and it is the taxpayer who decides to use it or not to use it.