The expenses of representation of companies and their taxation

Patrick Gordinne Perez2025-03-06T06:20:59+00:00Representation expenses are a key concept in the accounting and taxation of companies. These expenses may be linked to the attention of customers and suppliers, the promotion of the company and other activities related to the corporate image, their correct management is essential to optimise the tax burden and avoid problems with the Tax Agency, since not all these expenses are tax deductible.

What are entertainment expenses?

Entertainment expenses include payments made by a company to maintain and improve its image in the eyes of third parties, as well as to promote commercial relations. These can include activities such as meetings with clients, business meals, corporate events, promotional gifts and business trips.

Companies resort to these expenses in order to build customer loyalty, attract new opportunities and consolidate their brand in the sector. Although these expenses can provide strategic value to the company, their tax treatment is not always favourable, as the regulations establish certain criteria for their deduction.

In general terms, for a representation expense to be considered deductible, it must be directly related to the company’s economic activity, properly documented and recorded in the accounts.

Requirements for tax deduction

For entertainment expenses to be deductible for corporation tax purposes, they must meet certain requirements established by tax legislation:

- They must be directly related to the company’s economic activity. This means that the expense must objectively contribute to the generation of income or the maintenance of the business activity.

- Expenses that are personal in nature or that are not essential for the development of the business will not be accepted.

They must be duly justified by means of complete invoices that include the supplier’s details, a detailed description of the service or product purchased and the name of the company making the payment. Receipts and simple supporting documents may not be accepted in a tax inspection. - Expenses must be reflected in the company’s accounts and recorded in accordance with generally accepted accounting principles. Failure to record them in the accounts may result in the loss of the right to a tax deduction.

- They cannot be expressly excluded by tax regulations. Some types of expenses, such as those incurred in leisure establishments or personal gifts to employees, may not be considered deductible.

Limits on deductions for corporation tax purposes

Article 15 E of the Corporate Tax Act establishes a limit of 1% of turnover for the deduction of customer and supplier entertainment expenses. This means that if a company invoices 800,000 euros in a tax year, it can deduct up to 8,000 euros for entertainment expenses. If the expenses exceed this limit, the excess cannot be considered deductible, thus affecting the tax base.

It should be noted that this limit applies only to expenses related to hospitality for customers and suppliers. Other items, such as advertising, promotional events or attendance at trade fairs, may be subject to different tax treatment and in some cases may be fully deductible.

VAT treatment

The VAT paid on entertainment expenses is not always deductible. In general, the regulations state that VAT cannot be deducted on meals and hospitality for clients, as these expenses are considered to be of a personal nature. However, in certain cases, it is possible to deduct VAT, such as on business trips, accommodation expenses for business trips and advertising activities linked to the company’s economic activity.

It is important to review each expense individually to determine whether or not VAT can be deducted.

Entertainment expenses and income tax

For self-employed workers, entertainment expenses may be deductible from income tax if they meet the conditions established in the tax regulations. However, the Tax Agency tends to apply restrictive criteria in the acceptance of these expenses, demanding rigorous justification of their relationship with the professional activity.

For example, a self-employed worker who organises a business lunch with a client must demonstrate that the meeting had a strictly commercial purpose and that the expense was necessary to generate income. Failure to provide adequate justification may result in the expense not being accepted and an additional tax payment.

Advice for managing entertainment expenses

- Keep a detailed record of each expense.

- Always ask for invoices made out in your name.

- Consult a tax advisor before incurring significant entertainment expenses.

- Avoid including personal expenses to prevent problems with the tax authorities.

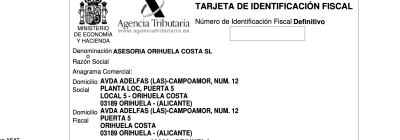

Asesoría Orihuela Costa

offers specialised advice on tax and accounting management for companies and the self-employed. We have a team of experts who will help you optimise your entertainment expenses and maximise tax deductions within the legal framework.

If you have any doubts about the taxation of these expenses, or if you need help with your company’s accounting, do not hesitate to contact our team.